All Categories

Featured

Table of Contents

Precious Liz: When is the "sweet spot" for me to start receiving Social Security advantages? I am retired and accumulating two government pension plans mine and my ex-husband's. I paid into Social Protection for 26 years of considerable incomes when I was in the private industry. I do not desire to return to work to reach 30 years of significant incomes in order to prevent the windfall removal stipulation decrease.

I am paying all of my expenses currently but will certainly do even more traveling when I am accumulating Social Safety and security. Should I wait until 70 to collect? I think I require to live until regarding 84 to make waiting an excellent selection. I attempted to get this solution from a monetary coordinator at a free seminar and he would not inform me without employing him for further consultations.

If your Social Safety advantage is absolutely "enjoyable cash," as opposed to the lifeline it offers as for lots of people, maximizing your advantage might not be your top concern. But obtain all the info you can concerning the cost and advantages of claiming at various ages prior to making your choice. Liz Weston, Licensed Financial Coordinator, is a personal financing writer for Inquiries may be sent to her at 3940 Laurel Canyon Blvd., No.

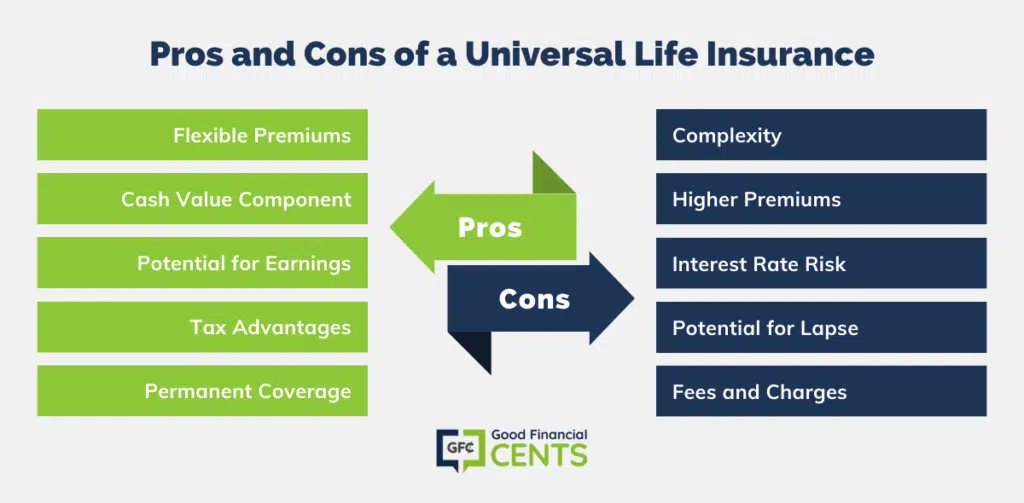

Cash value can collect and expand tax-deferred inside of your plan. It's vital to note that exceptional plan fundings accumulate passion and minimize cash money value and the fatality advantage.

If your cash worth falls short to expand, you might require to pay higher premiums to keep the policy in pressure. Policies might use various alternatives for growing your cash worth, so the crediting price depends on what you select and just how those choices do. A set sector makes passion at a defined price, which may transform over time with financial problems.

Neither kind of plan is necessarily much better than the other - all of it boils down to your objectives and approach. Entire life policies may attract you if you like predictability. You know exactly just how much you'll require to pay every year, and you can see just how much cash worth to anticipate in any kind of provided year.

Indexed Universal Life Insurance Comparison

When analyzing life insurance requires, examine your long-term goals, your current and future costs, and your desire for protection. Review your goals with your representative, and choose the policy that functions ideal for you.

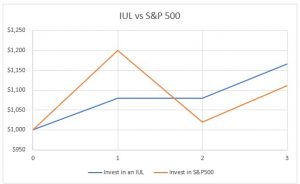

Last year the S&P 500 was up 16%, however the IULs growth is covered at 12%. 0% floor, 12% potential! These IULs overlook the presence of rewards.

Signature Indexed Universal Life

Second, this 0%/ 12% video game is basically a shop trick to make it seem like you constantly win, yet you do not. In the last 40 years, the S&P 500 was up 31 years. 21 of those were higher than 12%, balancing practically 22%. It ends up missing out on the massive growth hurts you way more than the 0% drawback assists.

If you need life insurance policy, purchase term, and invest the rest. -Jeremy by means of Instagram.

Your existing web browser may limit that experience. You may be making use of an old internet browser that's in need of support, or setups within your browser that are not suitable with our site.

Your existing browser: Finding ...

You will have will certainly provide certain offer particular yourself concerning your lifestyle in way of life to receive a get universal life insurance quoteInsurance coverage Smokers can expect to pay greater costs for life insurance coverage than non-smokers.

Cost Of Universal Life Insurance

If the plan you're considering is typically underwritten, you'll need to complete a clinical examination. This exam includes conference with a paraprofessional that will get a blood and pee example from you. Both samples will be evaluated for possible health and wellness threats that can affect the sort of insurance policy you can get.

Some elements to take into consideration consist of exactly how lots of dependents you have, exactly how lots of revenues are entering into your family and if you have expenses like a home mortgage that you would want life insurance to cover in the event of your death. Indexed universal life insurance policy is one of the much more complicated kinds of life insurance policy currently offered.

If you're looking for an easy-to-understand life insurance coverage policy, however, this might not be your finest choice. Prudential Insurance Policy Business and Voya Financial are some of the largest carriers of indexed global life insurance coverage.

Iul Life Insurance Canada

On April 2, 2020, "A Crucial Evaluation of Indexed Universal Life" was provided via different outlets, consisting of Joe Belth's blog site. (Belth's summary of the initial item can be located here. His follow-up blog site including this write-up can be discovered here.) Not surprisingly, that item created substantial remarks and criticism.

Some rejected my remarks as being "brainwashed" from my time functioning for Northwestern Mutual as a home workplace actuary from 1995 to 2005 "normal whole lifer" and "biased versus" items such as IUL. There is no challenging that I helped Northwestern Mutual. I appreciated my time there; I hold the company, its workers, its products, and its shared approach in high regard; and I'm happy for all of the lessons I discovered while employed there.

I am a fee-only insurance coverage expert, and I have a fiduciary obligation to look out for the ideal passions of my clients. By definition, I do not have a bias toward any sort of item, and as a matter of fact if I discover that IUL makes good sense for a customer, after that I have a commitment to not only present yet advise that option.

I constantly strive to place the most effective foot onward for my clients, which implies utilizing layouts that lessen or remove commission to the biggest degree possible within that specific policy/product. That doesn't always suggest recommending the policy with the most affordable payment as insurance policy is much more challenging than just comparing settlement (and sometimes with items like term or Ensured Universal Life there simply is no payment adaptability).

Some suggested that my degree of interest was clouding my reasoning. I like the life insurance policy market or at the very least what it might and need to be (indexed universal life insurance vs whole life insurance). And yes, I have an incredible amount of interest when it concerns wishing that the industry does not get yet an additional shiner with excessively positive pictures that established customers up for frustration or worse

Universal Life Insurance Tax Benefits

And now history is duplicating itself once more with IUL. Over-promise currently and under-deliver later. The even more points alter, the even more they remain the exact same. I might not be able to transform or conserve the sector from itself with respect to IUL products, and frankly that's not my objective. I want to aid my clients make best use of value and prevent important blunders and there are customers out there on a daily basis making inadequate decisions relative to life insurance policy and especially IUL.

Some people misinterpreted my criticism of IUL as a blanket recommendation of all things non-IUL. This can not be even more from the truth. I would certainly not personally advise the substantial bulk of life insurance policy plans in the marketplace for my customers, and it is uncommon to locate an existing UL or WL policy (or proposal) where the presence of a fee-only insurance coverage expert would certainly not include substantial client worth.

Latest Posts

Iul Life Insurance Canada

Is Iul Good For Retirement

Universal Insurance Usa